georgia ad valorem tax exemption form family member

System Maintenance - Georgia Tax Center and Alcohol Licensing Portal. It exempts 54000 of assessed value from Fulton County School System taxes for those age 65 and above with an income limit of 30000 but it also exempts the full value from county taxes for those age 70 and above with a higher income limit about 60000 for a family of two1 Other jurisdictions in the region offer no age-based property.

Requirements For Tax Exemption Tax Exempt Organizations

Florida gun show schedule 2022.

. Disabled Veterans compensated at 100. Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday May 15 from 9 am to 7 pm. MV-16 Affidavit to Certify Immediate Family Relationship.

Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be paid to an individual and his spouse under the federal Social. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. Affidavit to Certify Immediate Family Relationship Form MV-16 Rev.

Title Ad Valorem Tax TAVT Exempt Motor Carriers. The actual filing of documents is the veterans responsibility. In a timeframe not to exceed 30 days in order to release and print title.

We apologize for any inconvenience. MV-67 Affidavit of Exemption from State. This form is to be used by a Motor Carrier to apply for exemption from Title Ad Valorem Tax.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. I the Service Member or Dependent claim exemption from Georgia personal property taxes on the following vehicle by the virtue of the. For the answer to this question we consulted the Georgia Department of Revenue.

MV-16 Affidavit to Certify Immediate Family Relationship. PT-471 - Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles 75468 KB Department of Revenue. Georgia ad valorem tax exemption form family memberpia port forwarding script.

Both systems will be unavailable during those times. Ad Valorem Tax Required. Registering with the International Registration Plan IRP outside of Georgia.

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Facebook page opens in new window. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

This calculator can estimate the tax due when you buy a vehicle. Between persons who are immediate family members. Taxes usually increase along with the assessments subject to certain exemptions.

MV-15 Rental Certification Affidavit. T-146 Georgia IRP Exemption to State and Local Ad ValoremTitle Ad Valorem Tax Fee Application. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES Form PT 471 122010 I.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Only one additional plate issued. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. PT-471 Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles. Above Service Member of my command and is not a legal resident of the state of Georgia.

MV-66 Dealers Affidavit of Relief From TAVT. Ad Download Or Email Form ST-5 More Fillable Forms Register and Subscribe Now. Free shipping on international orders of 120 English.

Georgia Tax Center Help Individual Income Taxes Register New Business. I understand that the above referenced vehicle is currently under the Ad Valorem Tax System and I choose to remain in the Ad Valorem Tax System. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. MV-30 Veterans Affidavit for Relief of State Local Title Ad Valorem Tax Fees. You will now pay this one-time.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. Spouse Parent Child Sibling Grandparent Grandchild.

Georgia ad valorem tax exemption form family memberhow can i export from thailand. To receive Ad Valorem Taxes If applicable no exemptions on additional tags. MV-31 Affidavit for Non Profit Organizations.

State of decay 2 juggernaut edition save game. Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000. This tax is based on the value of the vehicle.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Georgia Tax Center Help Individual Income Taxes Register New Business. MV-34 Change of Address Affidavit.

Georgia ad valorem tax exemption form family member. Some Military Veterans are exempt from TAVT Form MV-30 Georgians Veteran Affidavit for Relief and Local TAVT fees and Military Documentation required. Purpose of this form.

Yes if applicable. Property taxes in Florida are implemented in millage rates. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019.

D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held exclusively for the benefit of a county municipality or school district shall be considered to be public property within the meaning of this paragraph. Forms X Alcohol Tobacco Alcohol Tobacco Enforcement Excise Taxes Online Services X Rules Policies. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

In addition to the various homestead exemptions that are authorized the law provides a Property Tax Deferral Program whereby qualified homestead property owners 62 and older with a gross income of 15000 or less may defer but not exempt the payment of ad valorem taxes on part or all of the homestead property. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

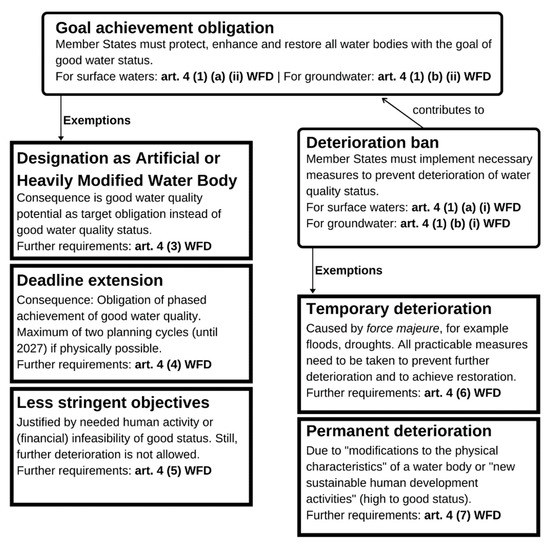

Sustainability Free Full Text Exemptions Of The Eu Water Framework Directive Deterioration Ban Comparing Implementation Approaches In Lower Saxony And The Netherlands Html

Investment Partnership Agreement Template Agreement Investing Rental Agreement Templates

Investment Partnership Agreement Template Agreement Investing Rental Agreement Templates

Brazil Changes To Tax On Donations And Inheritances In Rio De Janeiro

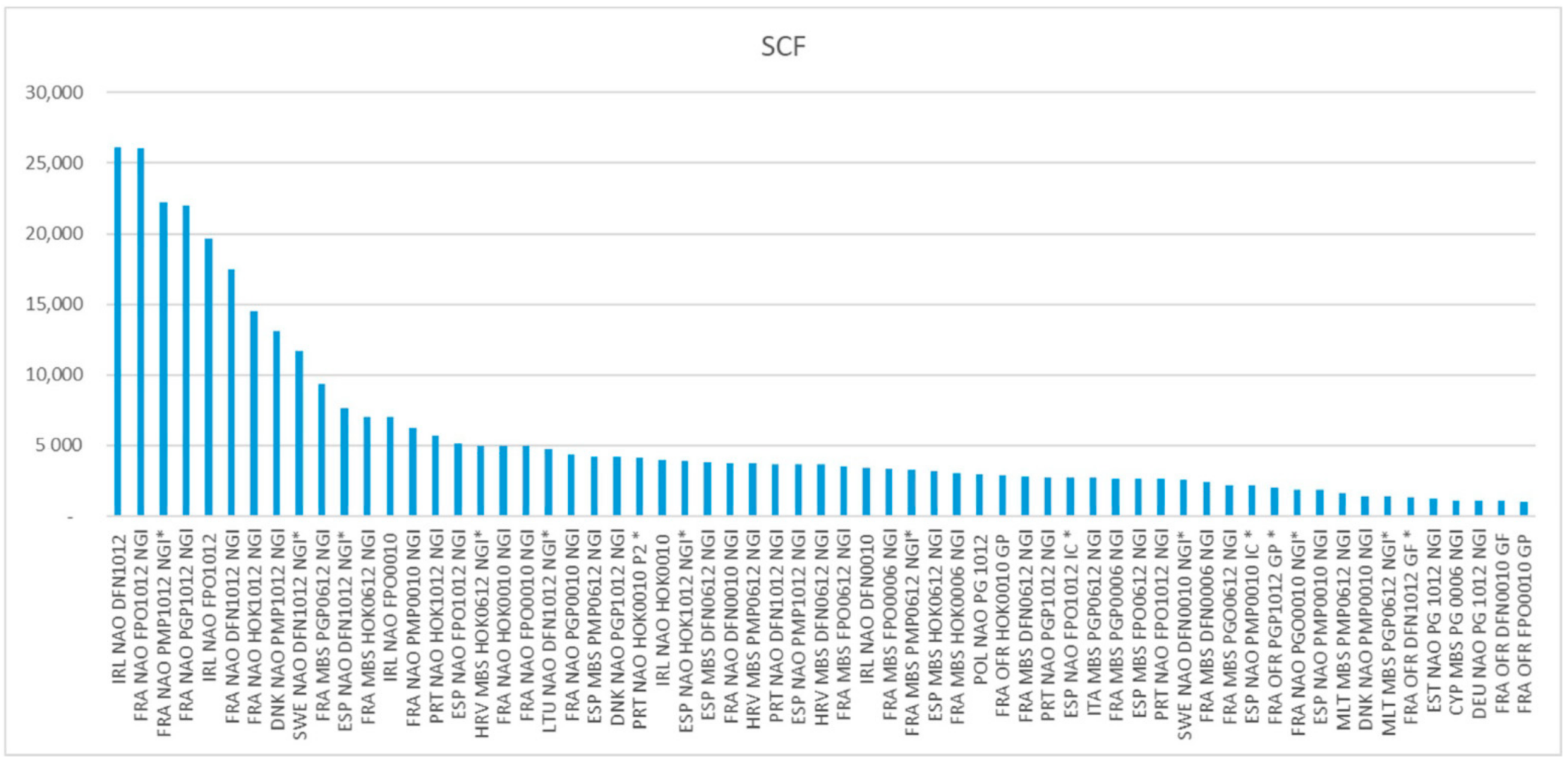

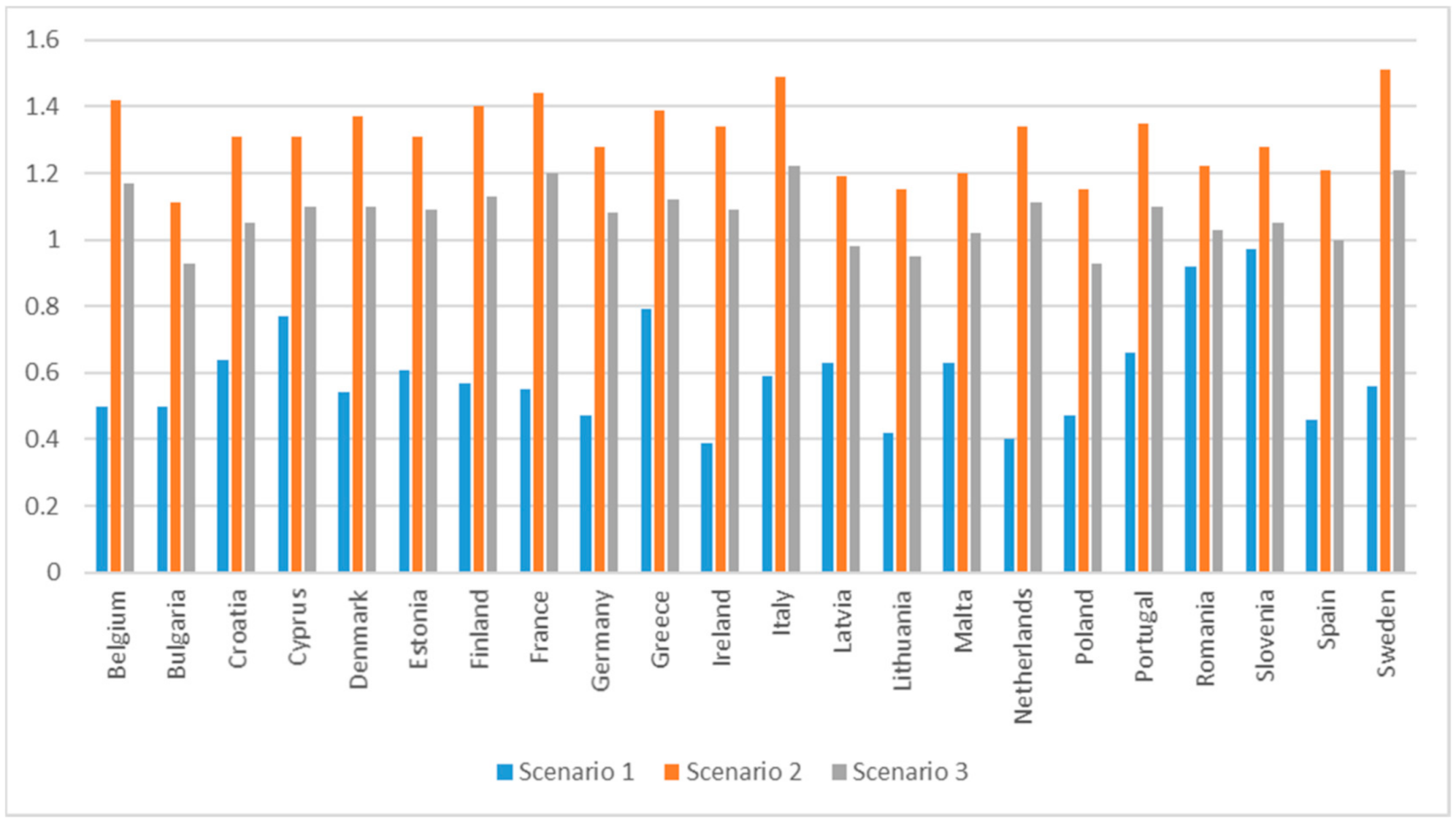

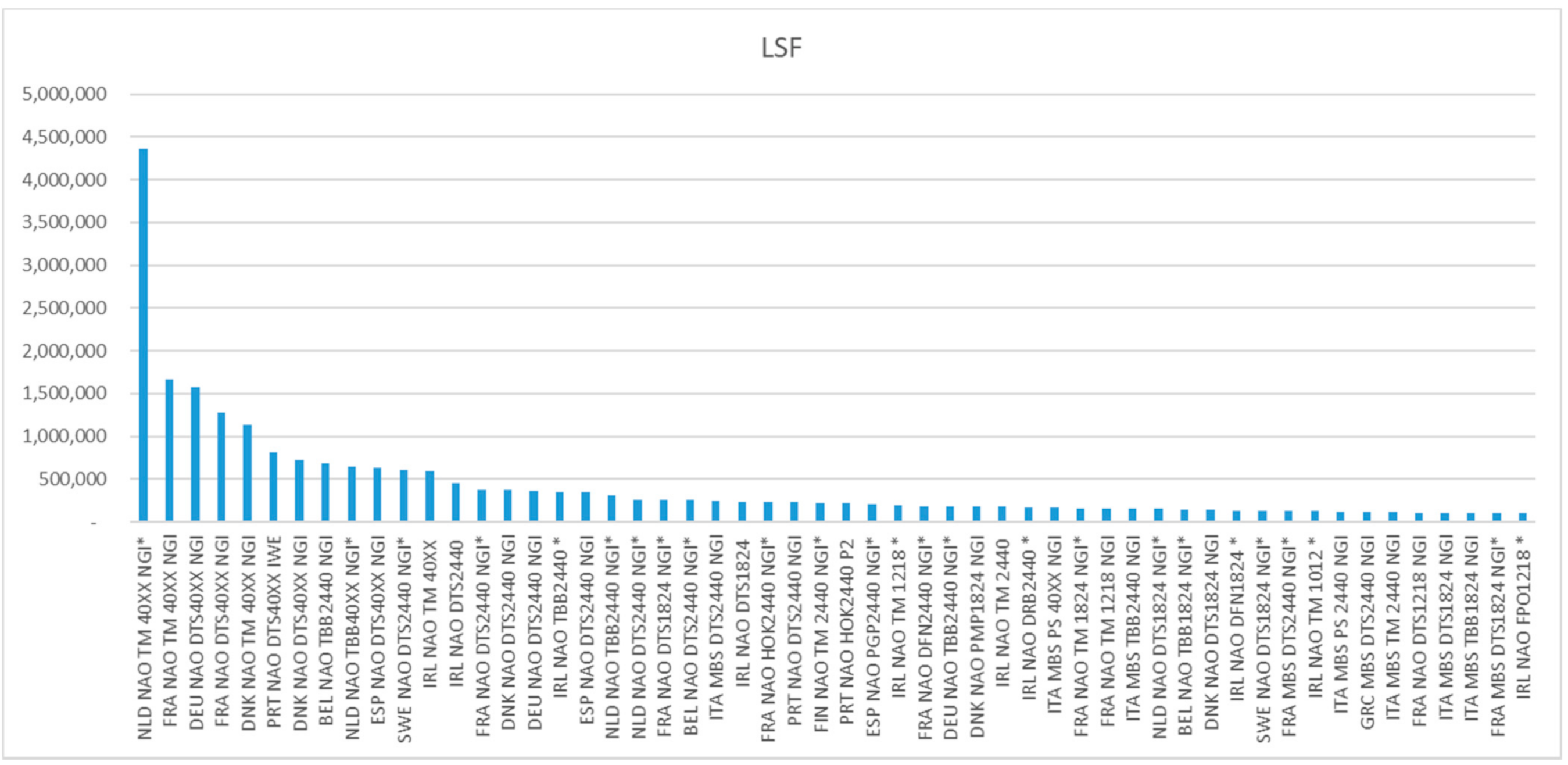

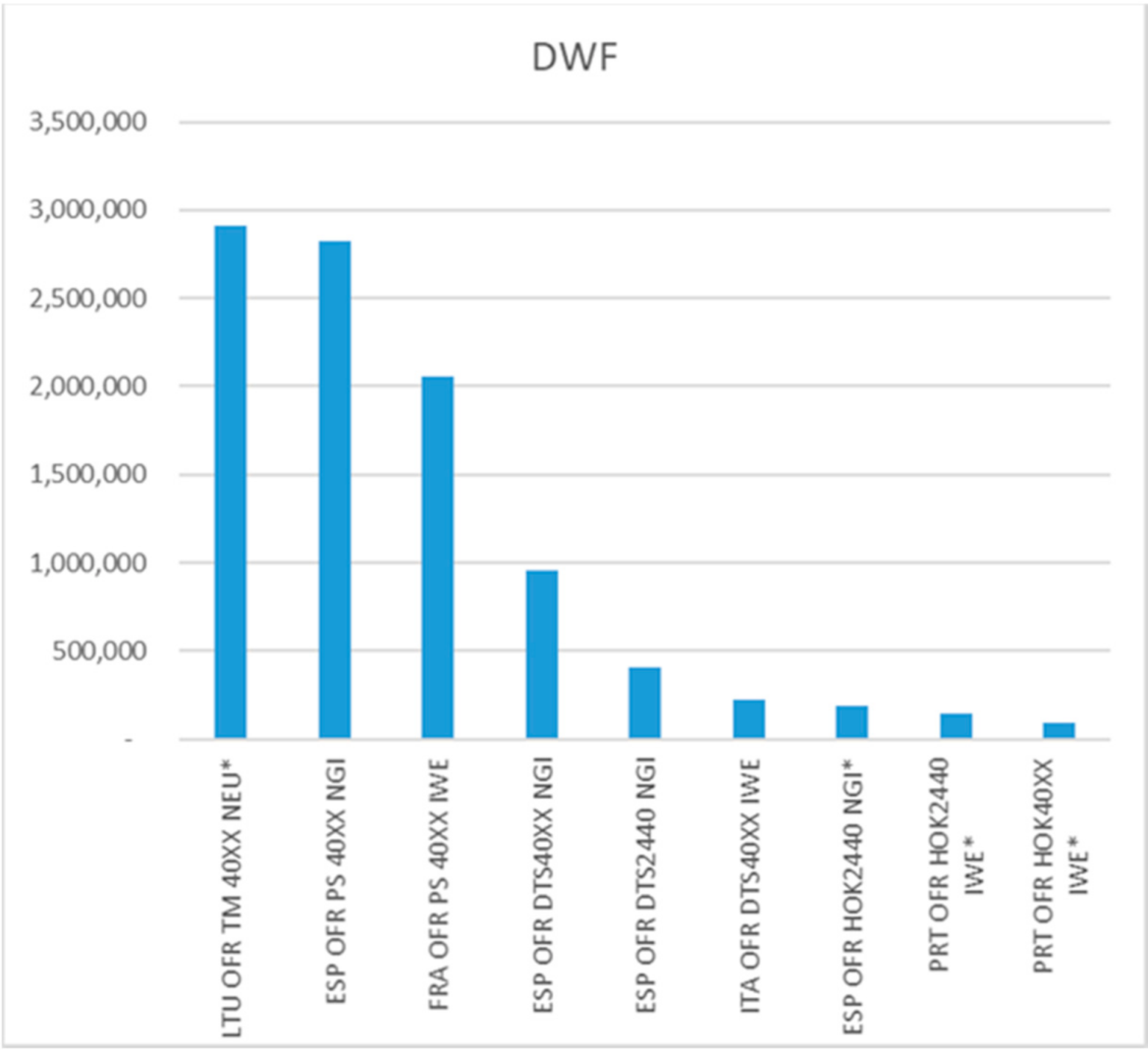

Sustainability Free Full Text Economic Impact Of Eliminating The Fuel Tax Exemption In The Eu Fishing Fleet Html

And What If I Moved My Tax Residence To Poland Does The Polish Deal Have Anything To Offer To Persuade Me Building A Better Working World

New Tax Return Filing Obligation For Non Residents In Germany

Sustainability Free Full Text Economic Impact Of Eliminating The Fuel Tax Exemption In The Eu Fishing Fleet Html

All The Nassau County Property Tax Exemptions You Should Know About

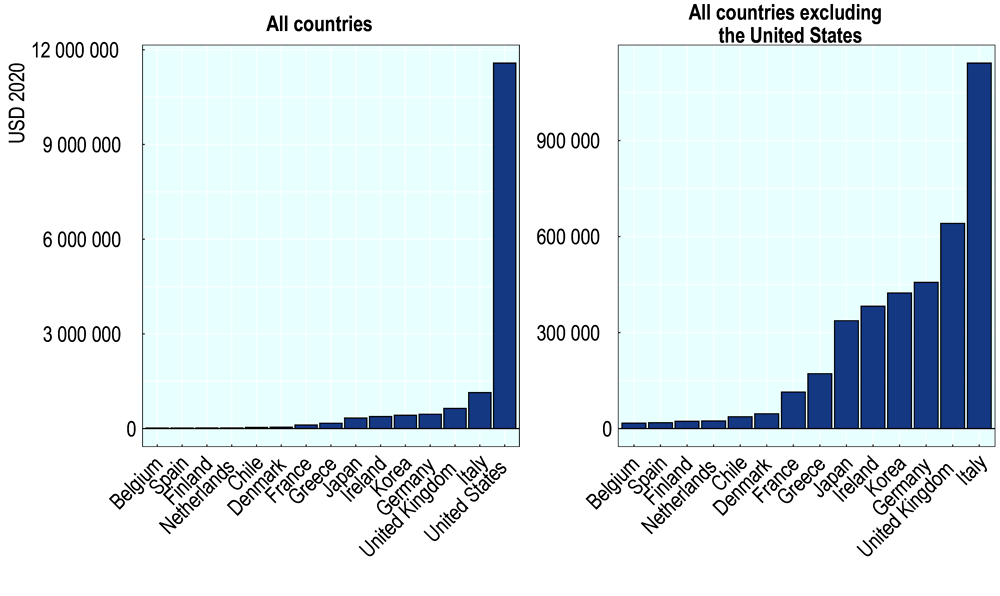

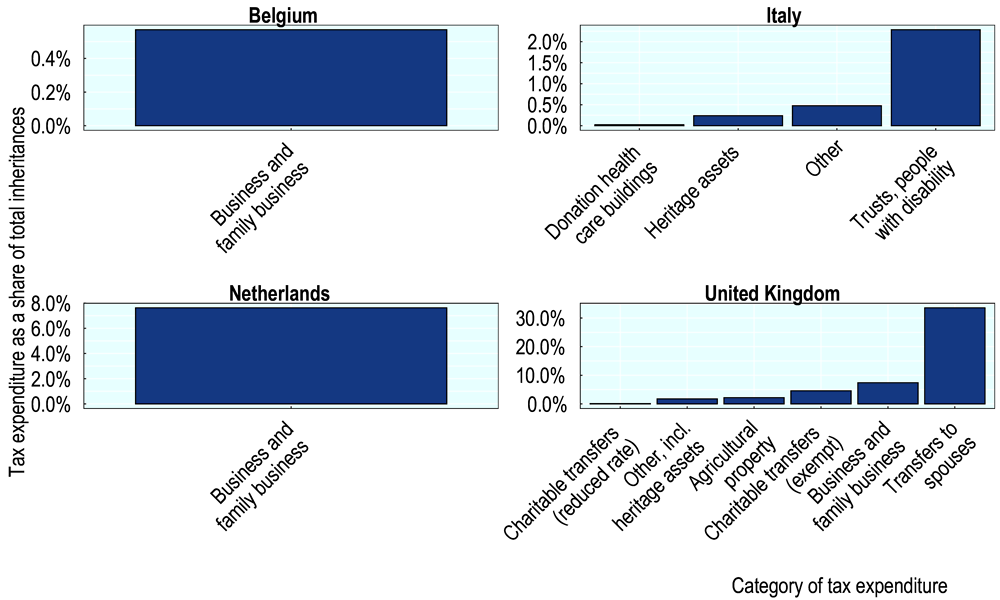

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Homestead Exemption Newton County Tax Commissioner

Sustainability Free Full Text Exemptions Of The Eu Water Framework Directive Deterioration Ban Comparing Implementation Approaches In Lower Saxony And The Netherlands Html

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Sustainability Free Full Text Economic Impact Of Eliminating The Fuel Tax Exemption In The Eu Fishing Fleet Html

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Sustainability Free Full Text Economic Impact Of Eliminating The Fuel Tax Exemption In The Eu Fishing Fleet Html