marin county property tax rate

Establishing tax levies estimating property worth and then receiving the tax. Secured property taxes are payable in two 2 installments which are due November 1.

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

Property Tax Bill Information and Due Dates.

. Overall there are three stages to real estate taxation. If you have questions about the following information. Tax Rate Areas Marin County 2022.

Information about all types of taxable residential property from real estate to boats and aircraft. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of. Tax Rate Book 2018-2019.

Tax Rate Book 2017-2018. Tax Rate Book 2020-2021. If you are a person with a disability and require an.

If you have questions about the following information. The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales. Taxing units include city county governments and various.

Tax Rate Book 2021-2022. Search Assessor Records. Secured property tax bills are mailed only once in October.

Marin County Property Search. For comparison the median home value in Marin County is 86800000. If you have questions about the following information.

Box 4220 San Rafael CA 94913. Information in all areas for Property Taxes. The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. Get free info about property tax appraised values tax exemptions and more. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. The Marin County Tax Collector offers electronic payment of property taxes by phone. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711.

Martin County collects on average 091 of a propertys assessed fair. County of Marin Property Tax Rate Book reports. Overview of Marin County CA Property Taxes.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools. Marin County Tax Collector PO. Download all California sales tax rates by zip code.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. If you are planning to buy a home in Marin County and want to understand the size of your property tax bill and. A valuable alternative data source to the Marin County CA Property Assessor.

The Tax Division includes the Property Tax and Tax Collector sectors within the Department of Finance. Tax Rate Book 2019-2020. Mina Martinovich Department of Finance.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

Marin County Mails Property Tax Bills Seeking 1 26b

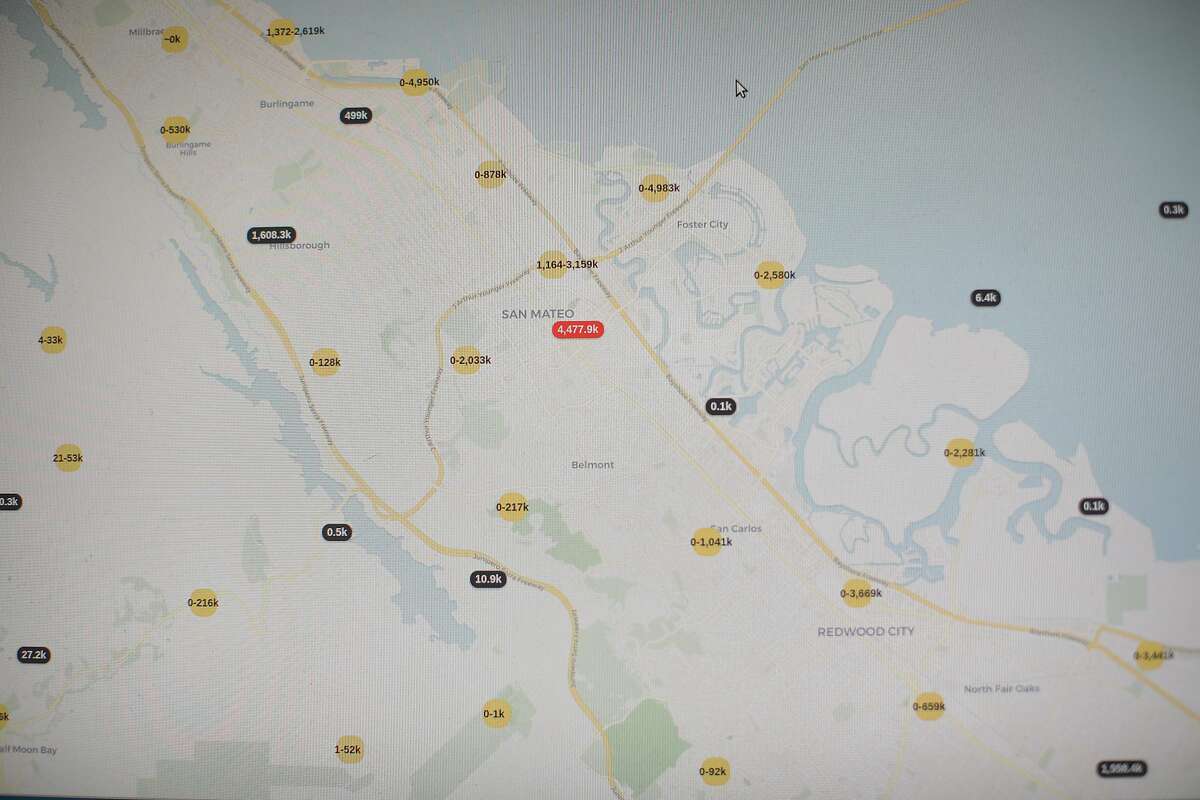

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Property Tax By County Property Tax Calculator Rethority

Marin Wildfire Prevention Authority Measure C Myparceltax

California Sales Tax Rate Rates Calculator Avalara

Marin County California Wikipedia

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

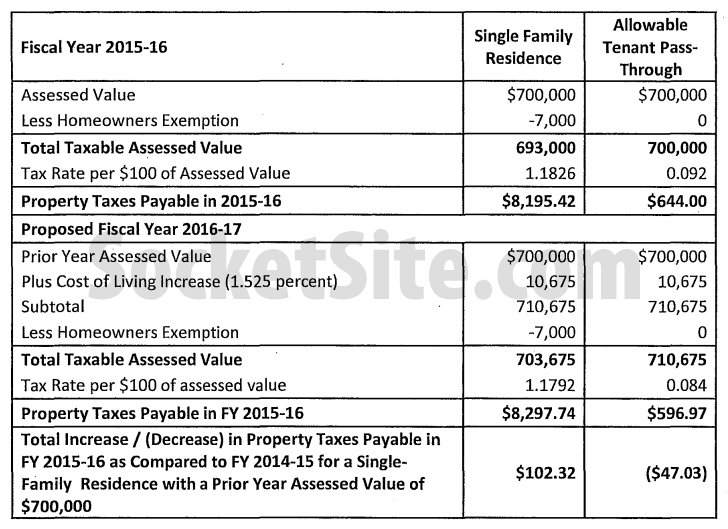

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

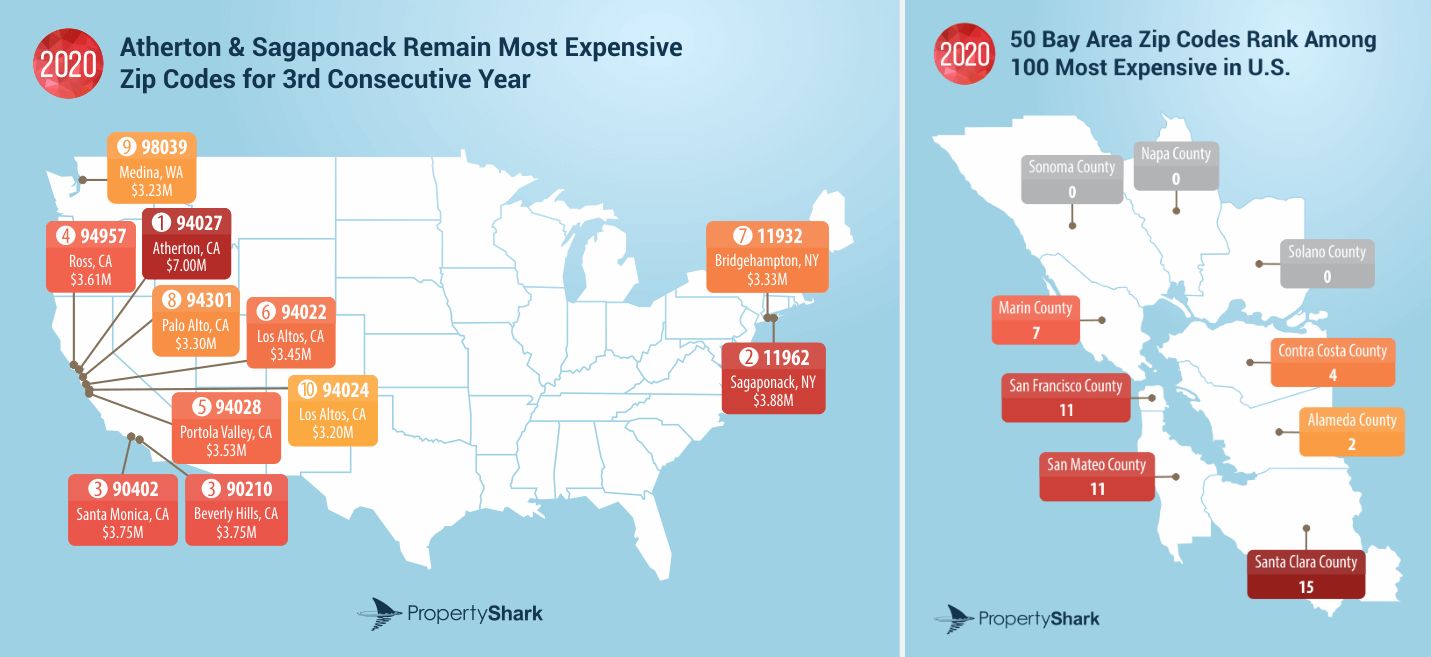

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

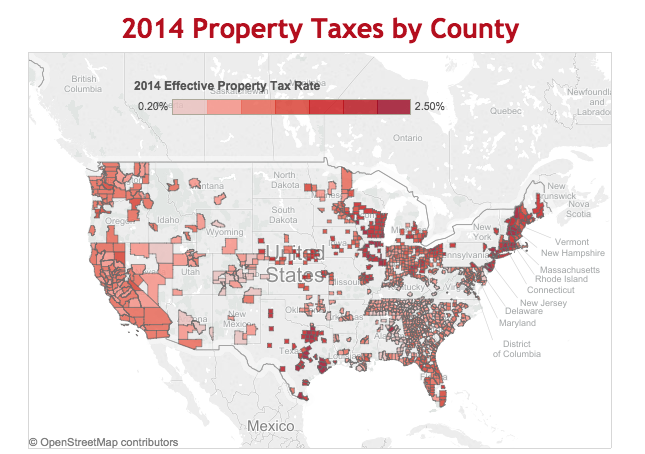

Pay Higher Than Average Property Taxes This Map Tells You And Who Pays 7x The National Rate Bobsullivan Net

Property Taxes Across The U S Rose To 328 Billion In 2021 Boston Agent Magazine

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

U S Property Taxes Levied On Single Family Homes In 2017 Increased 6 Percent To More Than 293 Billion Attom

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Understanding California S Property Taxes

8 Things To Know About San Francisco Property Tax Rates Mike Plotkowski

Here S Who Pays The Most And Least In Property Taxes

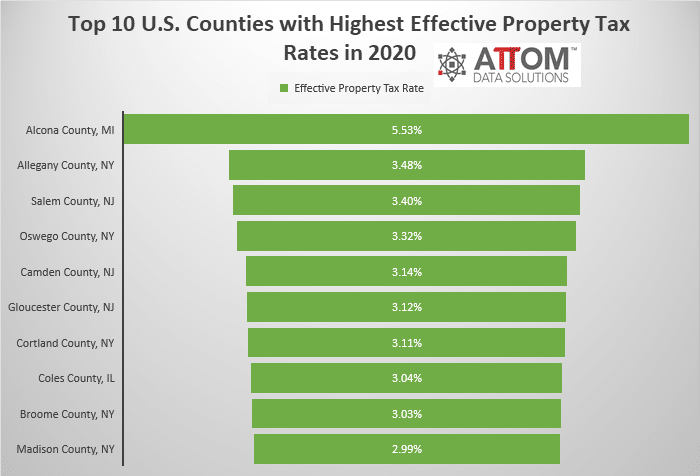

Top 10 U S Counties With Highest Effective Property Tax Rates Attom